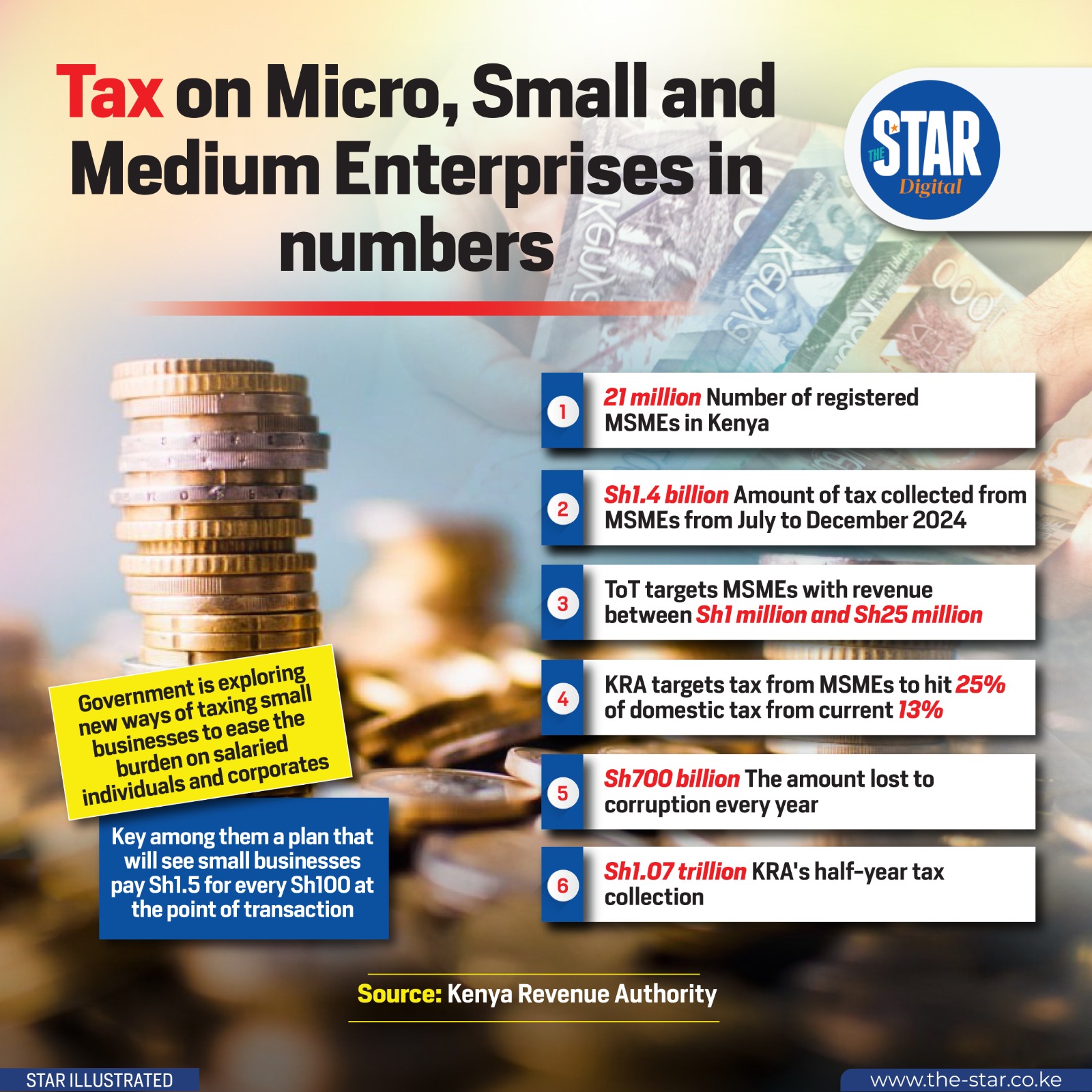

The government is exploring new ways of taxing small businesses to ease the burden on salaried individuals and corporates, key among them a plan that will see small businesses pay Sh1.5 for every Sh100 at the point of transaction.

Early this month, the revenue agency automated registration to the electric tax invoice management system, ensuring that invoices are captured in real-time for easier follow-up on collections.

Apart from this, the Kenya Revenue

Authority is further exploring ways to ensure taxpayers promptly remit

taxes to limit defaults that have seen

businesses lag on their tax obligations.