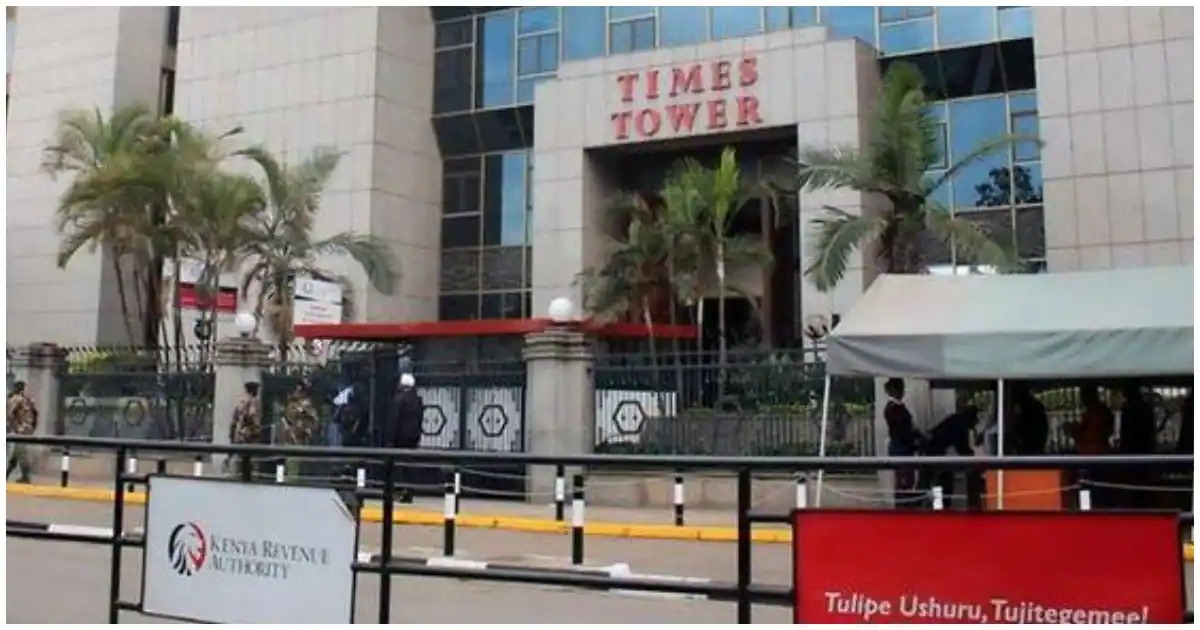

The initiative, part of the Finance Act 2023, comes after the success of a previous amnesty drive last year that saw over three million taxpayers benefit, with waivers amounting to Sh507.7 billion.

KRA is now encouraging eligible taxpayers to take advantage of this second chance, dubbed Tax Amnesty 2.0, to regularize their tax affairs and improve their financial standing.

Many taxpayers fall into debt not because they don’t want to pay, but due to financial hardship, confusion about compliance, or missing deadlines. The amnesty offers 100% relief on interest, penalties, and fines for tax debts. Taxpayers can apply through the iTax system and settle outstanding principal taxes through instalment payments by June 30, 2025.

A Path to Financial Reset

Officials say the amnesty is more than just financial relief. A clean tax record opens doors to better access to government services, bank loans, and business opportunities. By removing penalties and interest, KRA aims to help businesses and individuals rebuild financial credibility. Compliance becomes simpler and stress-free with this programme.

Applying for the tax amnesty is straightforward. Taxpayers can apply through the iTax platform by accessing the Amnesty application tab under Debt and Enforcement.

How to apply for Tax Amnesty

Step 1: Using any browser, log in to ‘iTax’, then go to the ‘Debt and enforcement’ menu and select ‘iTax Amnesty Application’.

Step 2: Under the section ‘A’, select the respective Tax obligation e.g. Value Added Tax. This will populate the periods with principal tax for the specific obligation. Where taxpayer had more than one obligation you click add and select the other obligation then go to B.

Step 3: Under section ‘B’, propose the number of instalments and instalment frequency. The system shall compute the amount per instalment. Click to agree to the terms and conditions and ‘Submit’ to complete the process.

Step 4: ‘Click’ to agree to the terms and conditions and submit. The iTax system will generate an amnesty application acknowledgement with amnesty and payment plan details.

Step 5: Generate payment slips for respective tax obligation and tax period through iTax and proceed to pay bank transfer or M-pesa Pay bill 222222.

Step 6: Once payment has been received, the iTax system shall vacate respective penalties and interest for the period and issue an amnesty certificate.

The KRA tax amnesty programme is a limited time offer and the expiration date is nearing. KRA has set the application and payment deadline for June 30, 2025. After this, any unpaid taxes will once again accrue penalties and interest.

If you have outstanding tax issues, now is the time to act. Visit the KRA website or your nearest office for more information.

If you’ve any

queries, contact KRA on social media on X at KRA

Care or Facebook

at Kenya Revenue Authority. You can also reach them by phone at

+254 20 4 999 999 or +254 711 099 999, or via email at [email protected].