Kenya's financial loss through illicit and unrecoverable financial flows has

more than doubled in the past four years to Sh243 billion as perpetrators

device new ways.

A new report by National Taxpayers Association and Oxfam shows that, compared to 2021, new avenues of illicit flows have emerged with businesses now at the centre of vice.

The report estimates that the country loses Sh243 to Sh253 billion annually through a toxic cocktail of corruption, illicit goods and trade mis-invoicing

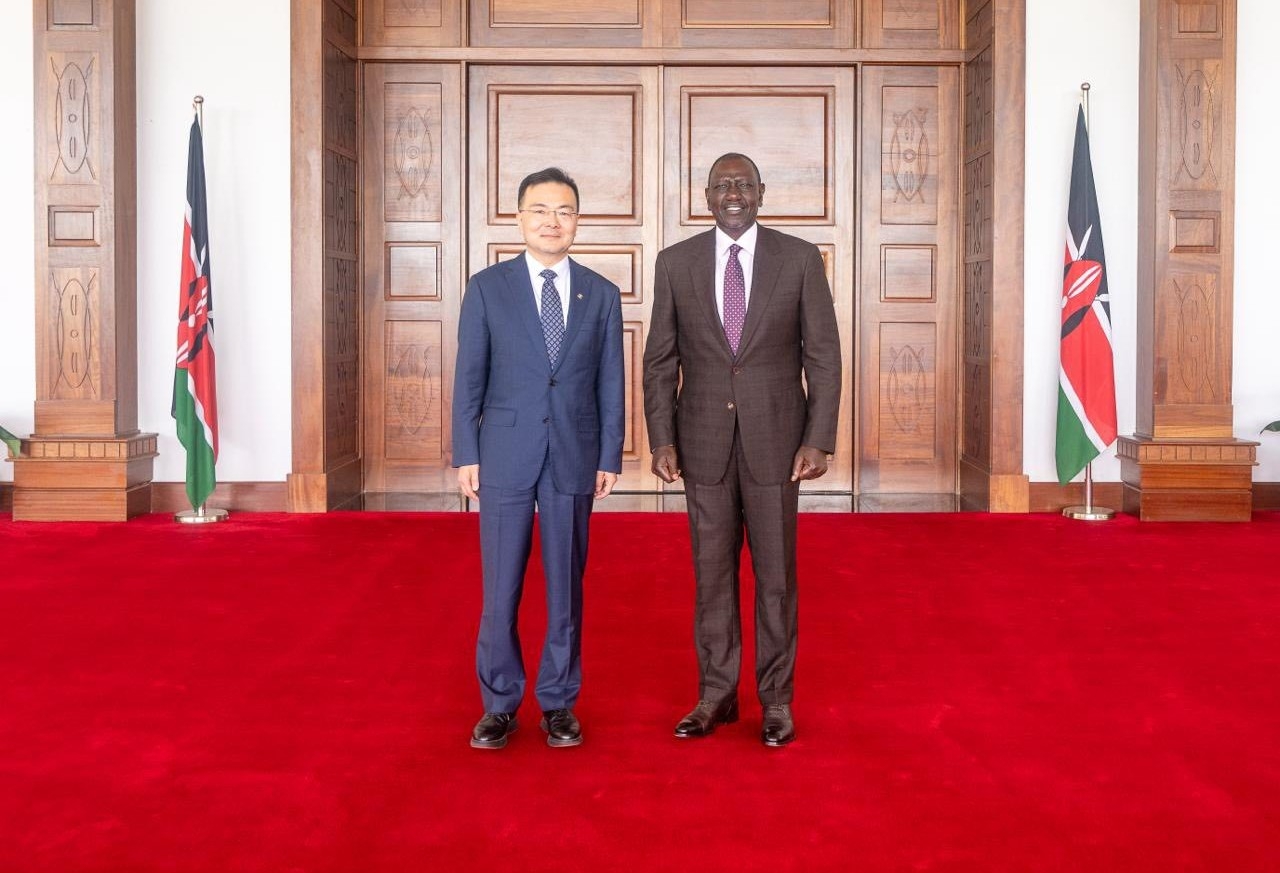

According to the findings presented by Senior Advisor for Tax and Fiscal Affairs in the Office of the President, Saidimu Terra Leseeto, counterfeiting alone is costing the country more than Sh153 billion every year.

Cigarettes, alcohol, pharmaceuticals, spare parts, textiles and manufactured goods being the most affected sectors.

The finding show that between 2015 and 2023, trade mis-invoicing accounted for an estimated Sh711 billion in unrecorded flows, averaging Sh79 billion annually.

“The gaps are widening, and this should be a concern for Kenya’s fiscal health. Unless addressed, these practices will continue undermining economic growth and fair competitio,” Leseeto warned.

The report shows that trade mis-invoicing is a major driver of IFFs, particularly involving imports from key partners such as China, India and the United Arab Emirates.

Unlike the visible menace of counterfeits, trade mis-invoicing operates in the shadows of customs paperwork and international data.

The study used the partner country method, comparing Kenya’s reported imports against its partners’ reported exports, the disparities are staggering, between 2016 and 2024, the mismatch amounted to $144 billion (Sh18 trillion).

By comparing UN trade data with Kenya’s customs declarations, analysts found wide discrepancies between what exporters report and what Kenya records as imports.

“For example, China reported exporting goods worth significantly more to Kenya than what Kenya declared as imports, pointing to possible under-invoicing,” added the advisor who acted as a consultant in the preparation of the report.

The Anti-Counterfeit Authority had earlier estimated that one in every five goods sold in Kenya is fake, leading to revenue losses exceeding Sh100 billion annually.

Citing industry data, Leseeto revealed that illicit cigarettes deny Kenya an estimated Sh6 billion in revenue annually, while about 21 per cent of alcohol sold in the country is illegal, translating to a tax loss of nearly Sh67 billion between 2021 and 2023.

The textile sector, particularly yarn products (fabrics, threads, ropes, and other textile goods), is also among the hardest hit, with counterfeit trade valued at Sh80 billion.

Kenya Revenue Authority (KRA) records show that illicit trade remains persistent, with goods worth Sh243 million seized and destroyed in 2024, up from Sh200 million the previous year.

Oxfam and NTA says that that figure is equivalent to nearly 10 per cent of the national budget, enough to double Kenya’s health budget or finance free secondary education for every child.

The Tax Justice Network estimates that tax abuse alone costs Kenya Sh25 billion annually, money that could finance 9.5 per cent of the health budget or four per cent of education spending.

Instead, it is vanishing into shadowy networks of counterfeiters, corrupt cartels and global traders who exploit loopholes in Kenya’s financial and regulatory systems.

“The size of value mismatch on international trade, established through PCM similarly shows an increasing disparity, hence value of mis-invoicing from a net value of KES 1 billion in 2016 (0.24 per cent) to a value of Sh180 billion in 2024 (19.81per cent),” the report reads in part.

China and India stood out, While Beijing and New Delhi recorded billions in exports destined for Nairobi, Kenya’s official import declarations showed only a sliver of those amounts.

The underreporting not only cheats the Kenya Revenue Authority (KRA) of customs duties but also facilitates capital flight and money laundering.

Globally, the OECD estimates businesses lose 2.5per cent of GDP to counterfeits, while the International Chamber of Commerce puts the figure at 3.3per cent of global trade.

Within the East African Community, counterfeits are estimated to cost about $500 million (Sh64.7 billion) annually.

The report recommends stronger collaboration among government agencies, development partners, and regulators to harmonize data collection and monitoring.

“From the observed data analysis outcome, it is appropriate to conclude that there is a price valuation gap and potential illicit trade facilitated by the exporters from the country of origin and the importers from the destination country like Kenya,” says the report in part.

NTA chief executive Patrick Nyangweso is now calling for tracking mechanisms to follow up on seized illicit goods, better enforcement against counterfeit networks and deeper research into the role of multinational companies in tax avoidance and profit shifting.

Kenya’s corruption is another artery feeding illicit flows. Between 2018 and 2024, the EACC received 35,680 corruption reports, but only 24 per cent were investigated.

Assets worth Sh66.9 billion were traced, yet less than half recovered with conviction rates in corruption cases hovering below 50 per cent.