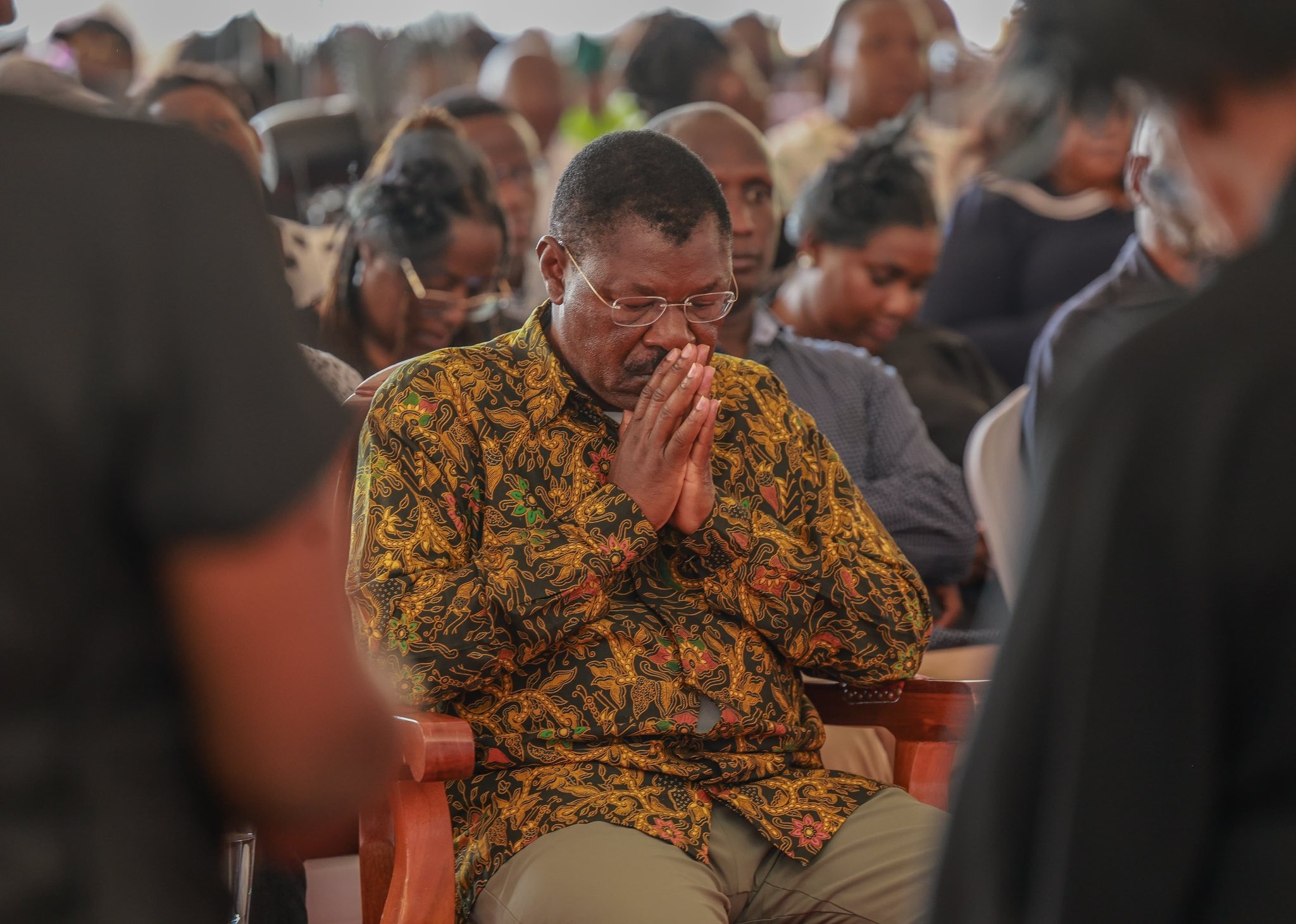

Kenya Diaspora Alliance chairperson Dr. Shem Ochuodho, the Chief Executive Officer and Principal Officer at Jubilee Health Insurance Njeri Jomo, Bupa Global Kenya Chief Executive Officer and Principal Officer Uditha Jayaratne and Kenbright CEO and Chief Actuary Ezekiel Macharia at launch of Global Medical Cover/HANDOUT

Kenya Diaspora Alliance chairperson Dr. Shem Ochuodho, the Chief Executive Officer and Principal Officer at Jubilee Health Insurance Njeri Jomo, Bupa Global Kenya Chief Executive Officer and Principal Officer Uditha Jayaratne and Kenbright CEO and Chief Actuary Ezekiel Macharia at launch of Global Medical Cover/HANDOUTKenyans living abroad are set to enjoy improved healthcare services for themselves and their loved ones back home following the launch of a Diaspora Medical Insurance Cover in Nairobi on Monday.

The new insurance product is a partnership bringing together the Kenya Diaspora Alliance (KDA), Bupa Global Kenya, Kenbright, and Jubilee Health Insurance.

Under the arrangement, Jubilee Health Insurance will provide local medical coverage in Kenya, while Bupa Global Kenya will cater to overseas healthcare needs. Kenbright will serve as the coordinating broker, ensuring seamless integration between local and international benefits.

“People abroad send money back home to their loved ones when they are sick, but with this cover, their relatives will access healthcare services seamlessly without disruptions,” said Njeri Jomo, Chief Executive Officer and Principal Officer at Jubilee Health Insurance.

Jomo noted that the new plan will ease the financial burden faced by Kenyans abroad who often send money home to support sick family members.

Jubilee Health Insurance Limited (JHIL) is the health insurance arm of Jubilee Holdings Limited, one of East Africa’s leading insurance providers with a strong footprint in Kenya’s private healthcare market.

Bupa Global Kenya Chief Executive Officer and Principal Officer Uditha Jayaratne said the cover will provide Kenyans abroad with access to quality healthcare across borders.

“Health cover is the most important protection you can give your loved ones,” Jayaratne said. “Since our focus is overseas, we will be able to identify the best hospitals abroad, coordinate transfers, and ensure members receive the care they need—that’s what we specialise in.”

Bupa Global Kenya is the locally licensed arm of Bupa Global, the international private medical insurance division of UK-based Bupa, which operates in over 190 countries.

Kenbright CEO and Chief Actuary Ezekiel Macharia highlighted that the partnership bridges the gap between local and global healthcare access.

“You can buy a cover here at home and use it wherever you are,” Macharia said, underscoring the convenience and flexibility of the new insurance plan.

Kenya Diaspora Alliance (KDA) Chairperson Dr. Shem Ochuodho welcomed the initiative, describing the diaspora community as an “untapped goldmine” for Kenya’s development.

“We want to encourage the diaspora to invest back home. One way to do this is by reducing the amount of money they send for medical emergencies and instead channeling it into insurance cover,” Ochuodho said.

KDA, which represents more than 300,000 Kenyans living abroad, advocates for the welfare and empowerment of the diaspora community.

Ochuodho added that the new insurance product provides an

opportunity for Kenyans abroad to contribute more effectively to the country’s

economic growth.

Diaspora remittances are a major source of foreign exchange for Kenya, surpassing traditional exports such as tea and coffee. The funds—mainly from countries like the United States, Germany, Australia, the UAE, Tanzania, and Canada—support families, investments, and the national economy.

The Diaspora Medical Insurance Cover is expected to make healthcare access more reliable and affordable for thousands of Kenyan families with relatives abroad, marking a milestone in cross-border insurance innovation.