Football derbies between Manchester United and Arsenal

Football Clubs are usually crowd-pullers, only rivalled by Manchester City FC

when it comes to the English Premier League.

In Kenya, contests between Arsenal and Manchester United,

simply known as Man-U, are even more contentious as the fans cheer their teams

on TV screens, not bothered by the fact that their cheering is not heard by the

players.

A loss by either side leaves the majority of Kenyan fans

disappointed and at times heartbroken, despite their long distances from the

playing fields. What is their motivation? One wonders.

Most of them are driven by sheer love of watching football

matches, while others are there to track bet predictions they normally place in

favour of either Arsenal, Man-U, Manchester City or other football clubs.

A case in point is that of a small business owner, Mr.

Domenic Nzioki.

Nzioki, 25, who resides at Nairobi’s Kasarani estate and is

a ‘smokie’ and boiled eggs hawker, was recently found by this writer lamenting

how much loss he had suffered from putting a stake in one of the betting sites.

The poor Nzioki looked haggard, devastated, and completely

heartbroken from the results of his unfavourable prediction.

Full of regrets, he explained how he lost Sh42,000, which

could have helped him advance his small business and attain more money to

increase the number of ‘smokie’ trolleys as per his dream.

“I could have bought tomatoes and onions to spice up the

‘kachumbari’ and even purchased ‘choma’ (barbeque) sauce as well as chilli

sauce. Now that the money is gone, how will I be able to do that?” Nzioki wept.

But, all of a sudden, the young Nzioki was all glows and

shouted: “Hurrah! Come to think of it.” On enquiring whether the results had

been overturned by a different bet, the young man said he had just thought of

Hustler Fund as his fallback plan and sought to know from this writer the

procedure of accessing money from it.

Through the equalisation fund, the government has provided a

solution for all micro, small and medium enterprises to begin and stay afloat

in their businesses without going for predatory lenders or betting companies

for survival.

The Micro, Small and Medium Enterprises (MSMEs) form the backbone of Kenya’s economy, contributing significantly to employment, innovation and income generation.

It is in government records that MSMEs account for over 80

percent of employment outside the formal sector and contribute roughly 33–40

percent of Kenya’s Gross Domestic Product (GDP).

For years, the MSME sector has faced persistent challenges

such as limited access to credit, inadequate financial infrastructure,

informality, and inadequate skills and business support.

These barriers have historically hindered small businesses’

growth and sustainability, just like that of Nzioki, as the players lack the

capacity to remain independent and fund their businesses to exponential growth.

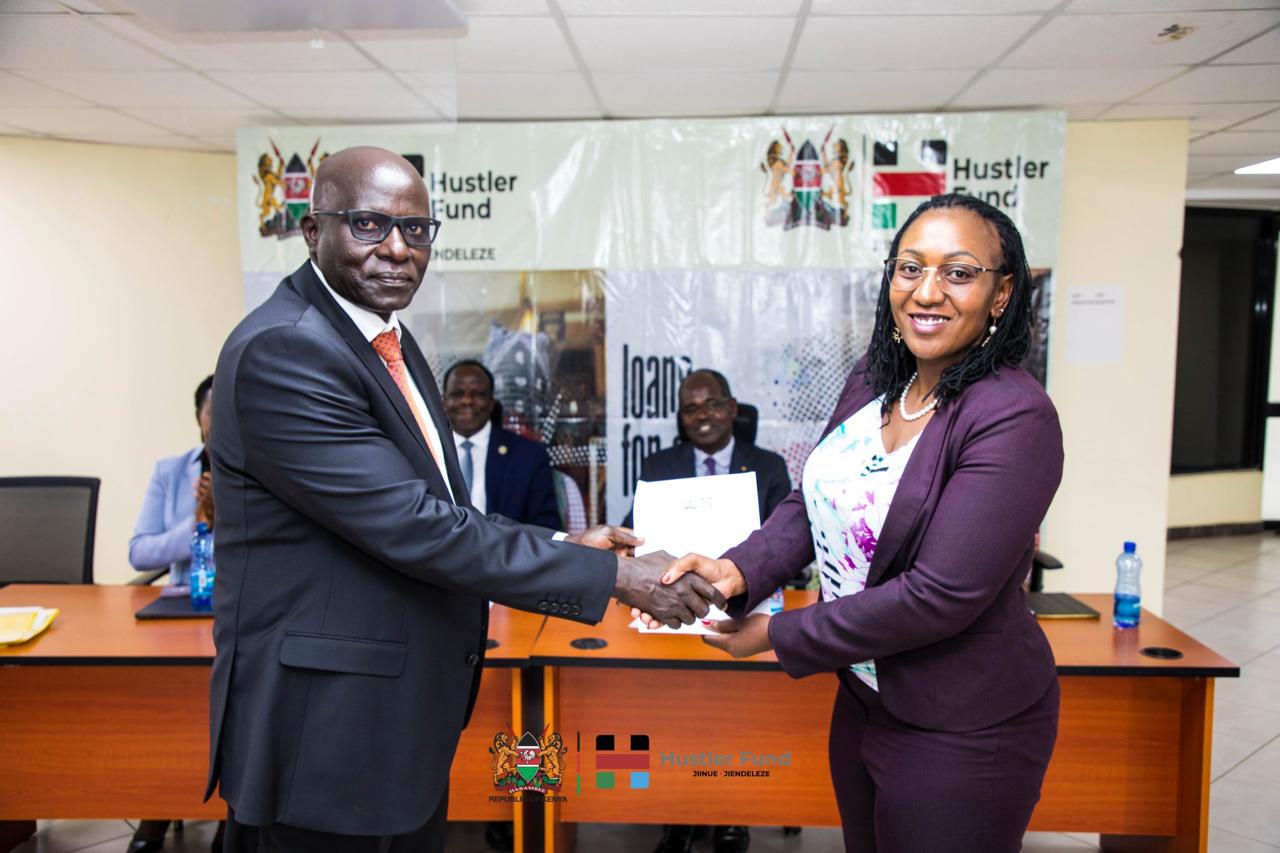

The Hustler Fund was set up and rolled out in November 2022

with the aim of addressing these challenges by expanding access to affordable

and inclusive financing for individuals and informal businesses that are

typically excluded from the mainstream financial system.

Through mobile-based micro-loans, savings, and eventual

pension and insurance products, the Hustler Fund aims to empower millions of

people, particularly those in the lower-income brackets, by promoting financial

inclusion, responsible borrowing, and enterprise growth.

From this scenario, it is evident that President William

Ruto’s aspiration of transforming the MSME economy to absorb the young Kenyans

joining the workforce and grow operational surplus for workers is a success

story because most youth are now independent and advancing their businesses

significantly.

When the Hustler Fund was rolled out, it only addressed

urgent needs which were access to affordable, collateral-free credit because

small-scale traders such as boda boda operators, mama mbogas, and artisans

were, before then, at the mercy of fintechs and shylocks alongside other

unregulated digital lenders who charged them exploitative interest rates and

illegal penalties.

Aware of these borrowers’ challenges, the government in

extension rolled out a nationwide financial literacy programme to help them

understand the fundamentals of borrowing from registered lenders (those

registered with the Central Bank), how to manage their money well through

record keeping, and how better to grow their businesses.

Community outreach through local leaders and SACCOs was

maximised to ensure that even in remote areas, citizens could access both

financing and mentorship.

By 2024, the Hustler Fund had moved from simply offering

individual microloans to supporting organised groups and registered

enterprises.

New products were introduced, targeting youth and women

groups, cooperatives, and startups with proven growth potential.

The aim was no longer just to support survival but to enable

scaling up, turning roadside stalls into shops and side hustles into fully

developed businesses.

In the same year, an MSME Credit Guarantee Scheme was

established, allowing banks and other financial institutions to lend to small

businesses with reduced risks while still maintaining commercial standards.

The Ministry of Cooperatives and MSME Development became

increasingly active in creating conducive ecosystems for business growth.

Through county-based MSME hubs, entrepreneurs have gradually

gained access to shared workspaces, internet connectivity, product development

services, and government procurement opportunities.

From November 2022 to September 2025, the Hustler Fund has

evolved from a simple financial lifeline into a transformative national

movement fueling a growing culture of entrepreneurship and financial inclusion.

As the Kenya Kwanza administration crosses the third year, the Hustler Fund has matured into more than a financing tool; it has become the cornerstone of a broader economic empowerment strategy.

The strategy has seen the government launch the MSME Market

Access Initiative, opening up regional and international markets for Kenyan

products, especially those crafted by small manufacturers and cooperatives.

Digital training programmes have empowered entrepreneurs to

move their businesses online, improving efficiency, visibility, and customer

reach.

The administration’s push for digital inclusion has also

ensured that even the smallest enterprises are now part of Kenya’s digital

economy.

A key feature of the third year has been the government’s

investment in tools of trade.

Through various public-private partnerships, the Jua Kali

sector has received modern equipment, protective gear, and support in product

standardisation.

Artisans are now able to produce goods that meet industry

and export standards, and many are benefiting from direct government orders for

furniture, school desks, and construction materials.

This demand-driven approach has increased job creation and

given dignity to work traditionally associated with informal labour.

Today, 26.5 million Kenyans are subscribed to the Hustler

Fund either individually or in groups.

Women account for more than half of the beneficiaries, while

youth-led businesses have experienced notable growth.

The informal sector is slowly shedding its invisibility,

with many small businesses transitioning into the formal economy, acquiring

credit histories, and even registering for taxation.

President Ruto’s vision to create a bottom-up economy has

taken root as the focus shifts from dependency to productivity, and from

short-term survival to long-term enterprise development.

While challenges like high inflation still abound, the

foundation laid by the Hustler Fund and accompanying MSME policies are proving

resilient.

The government’s continued investment in this space signals

a long-term commitment to ensure that no Kenyan is left behind in the journey

toward shared prosperity.

As the country looks ahead to the fourth year of the

administration, one thing is clear: the hustler economy is no longer a slogan.

It is now a structured and evolving pillar of Kenya’s economic transformation.

Oprah Nyaboke works at the Office of Government Spokesperson-Ke.