Agriculture sector stakeholders have issued call for tax and regulatory reforms, warning that the current policy environment is undermining competitiveness and threatening the survival of businesses across key value chains.

They raised concerns over unpredictable taxation, delayed VAT refunds, high regulatory levies and mounting cross-county charges, saying these are pushing up production costs and weakening Kenya’s position in regional and global markets.

A major concern is the need to harmonise VAT on agricultural produce and inputs and according to the memorandum, stakeholders want a stable regime where products are either zero-rated or VAT-exempt for at least ten years to support long-term planning.

They also noted that the government owes the private sector more than Sh150 billion in VAT refunds; a backlog they said is forcing companies to scale down or shut down.

They further warned that duties on packaging materials, including Kraft paper, are inflating production costs and hurting exporters.

According to them, some players are paying up to 60 per cent in combined duties, making Kenyan goods less competitive.

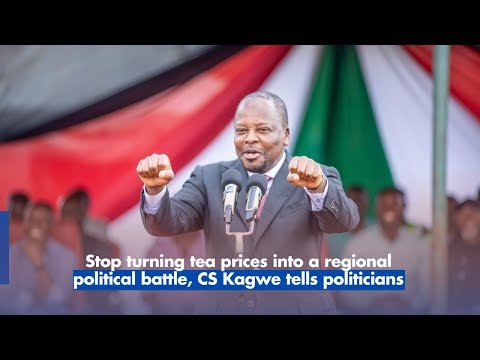

The demands were presented on Tuesday in Nairobi during a stakeholder forum convened by the Cabinet Secretary for Agriculture and Livestock Development Mutahi Kagwe.

The forum brought together the National Treasury, the Council of Governors, Kenya Revenue Authority and several regulatory agencies to listen to concerns raised by farmers, processors and private-sector associations.

During the session, stakeholders handed over memorandum to National Treasury Principal Secretary Chris Kiptoo and Council of Governors Chair and Wajir Governor Ahmed Abdullahi.

Stakeholders urged the government to address challenges arising from eTIMS compliance, saying many farmers cannot meet documentation requirements adding that this could drive farmers to informal markets, disrupting structured value chains.

Other concerns included a 30 per cent tariff imposed by India on some Kenyan exports but not on products from Uganda and Tanzania, the introduction of 2 per cent land rates on farmland, cross-county cess charges and duplicated regulatory levies, including a proposed 0.2 per cent standards levy.

They also called for stronger surveillance and extension services to curb illegal trade in raw commodities, ensure seed certification, and support pest and disease control.

In response, Treasury PS said the government will factor the issues into the national budgeting process.

He outlined plans to review taxes and levies affecting agriculture and reaffirmed the state's commitment to a predictable tax environment.

“As we work on the harmonization of tax, we are also considering a one-off payment of VAT refunds alongside pending bills to ensure that industries do not close down,” Kiptoo said.

He added that regulators will be convened to review all levies and assess whether some can be reduced.

COG Chair Ahmed Abdullahi said counties will strengthen extension services and review contentious taxes. He admitted that cross-county cess is illegal adding that impacts commodity prices in other counties.

The PS added that the agricultural committee will also review land rates because of their impact on farmers.

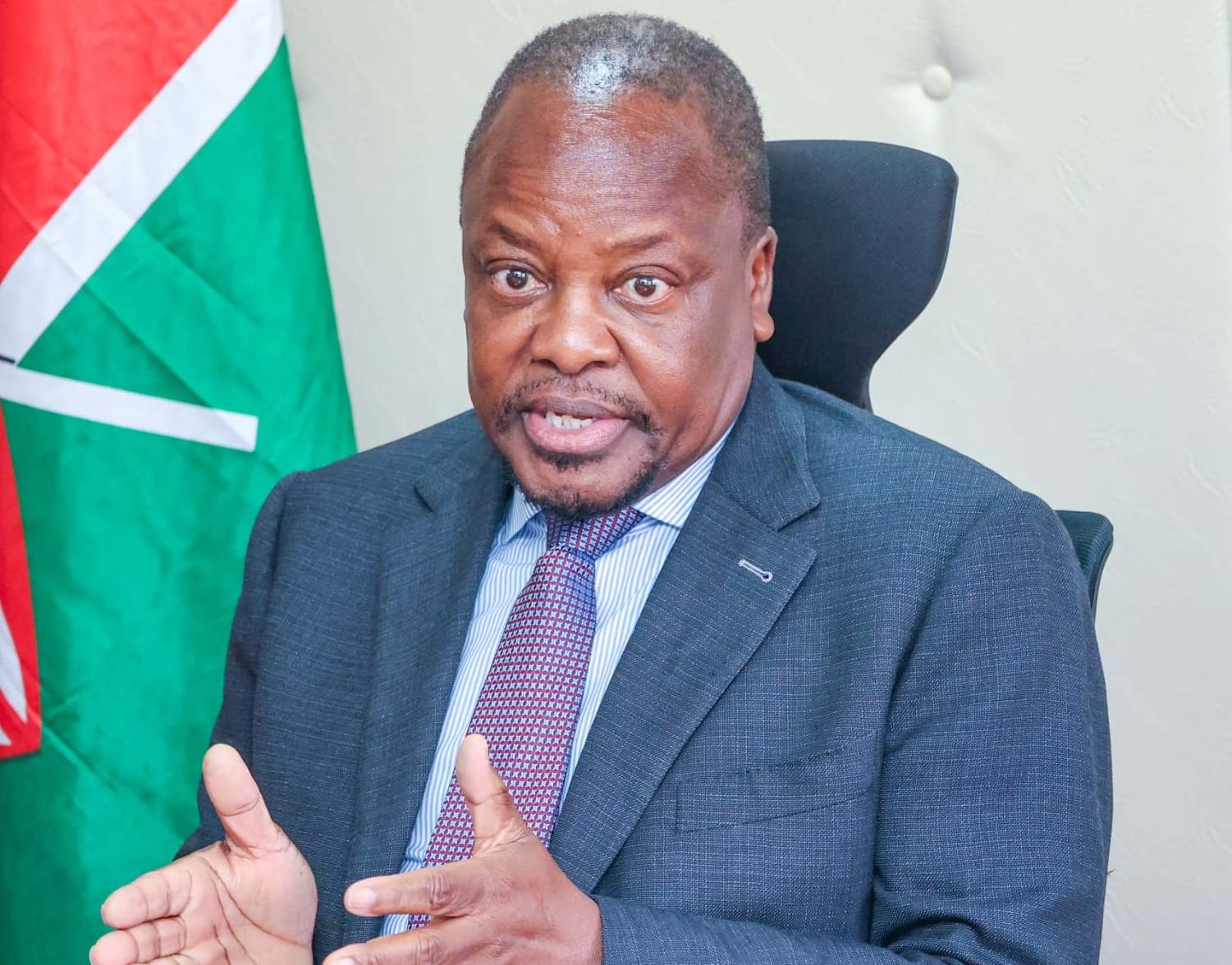

Agriculture CS Mutahi Kagwe among other leaders, during a stakeholders meeting on Novemmber 18, 2025 / HANDOUT

Agriculture CS Mutahi Kagwe among other leaders, during a stakeholders meeting on Novemmber 18, 2025 / HANDOUTCS Kagwe promised to escalate unresolved issues to the Cabinet, particularly the VAT backlog and pending bills.

However, he challenged the sector to embrace technology to boost productivity.

“We cannot get more land; land is a finite resource, but through the adoption of technology such as AI, we can increase crop production per acre,” he said.

He urged stakeholders to maintain ethical practices in agricultural exports to safeguard Kenya’s reputation.

The memorandum was presented by a broad coalition of private-sector groups across major value chains, including the Agricultural Sector Network (ASNET), Fertiliser Association of Kenya (FA-K), Kenya National Agrodealers Association (KENADA), Cereal Growers Association (CGA) and Cereal Millers Association (CMA).

Others are the Kenya Flower Council (KFC) and Fresh Produce Exporters Association (FPEAK), New KPCU, Kenya Tea Growers Association (KTGA) and Kenya Tea Development Agency (KTDA), Macadamia Nuts (MacNut) and Avocado Society of Kenya (ASOK), Kenya Dairy Producers Association (KDPA) and Association of Kenya Feed Manufacturers (AKEFEMA).

Also present were the Kenya Poultry Farmers Association (KEPOFA), Leather Apex Society of Kenya (LASK), Veterinary Inputs Suppliers of Kenya (VASIK), Kenya Veterinary Association (KVA), and the Veterinary Paraprofessionals Association of Kenya.