Kenya's long-held dream of becoming an oil exporter is seeing renewed progress through the South Lokichar basin, with Gulf Energy now taking over the project

from Tullow. The government is also keen to enhance LPG penetration to about 70 per cent by 2028. Principal Secretary for the State Department for Petroleum, Mohamed Liban, spoke on the industry performance, impact on the economy and the future.

How would you describe Kenya’s petroleum industry?

The Petroleum industry has three major sectors that is, the upstream sector, the midstream and the downstream sector. Upstream petroleum operations comprise all or any of the operations related to the exploration, development, production, separation and treatment, storage and transportation of petroleum up to the agreed delivery point.

As a country, we have four primary sedimentary oil basins, which are the focus of petroleum exploration activities. These are the Lamu, Anza, Mandera and Tertiary Rift basins. All four of these basins have confirmed mature hydrocarbon systems capable of accumulating oil and gas reserves.

While we are yet to become a commercial producer, Kenya appeared on a recent report on oil-producing countries alongside Morocco, Nigeria, Egypt, Libya and South Africa, and God willing, we are headed there, to the top five.

Midstream petroleum operations, on the other hand, comprise all operations related to petroleum transportation, storage, refining operations, or natural gas processing operations that are related to multiple development areas, including operations for the liquefaction of natural gas.

Then we have the downstream, which comprises the operations related to the distribution of petroleum to residential, industrial, power generation and other end users. So generally, Kenya’s petroleum sector encompasses the exploration, extraction, refining, distribution and utilisation of petroleum resources within the country.

What is the sector’s impact?

Kenya’s oil and gas industry plays a crucial role in the economy, contributing to revenue generation, job creation and energy supply. It continues to positively impact livelihoods and this is illustrated by the investments made by the Oil Marketing Companies (OMCs) across the country and beyond.

Petroleum and energy dealers are an enterprise anchored by OMC investors putting up retail energy stations across the country. These stations are a critical last-mile delivery unit for not only petroleum products but also for LPG, lubricants, greases, coolants and more.

The approximately 4,800 retail energy stations in the country provide livelihoods for an estimated 100,000 employees. In addition to this, there are several indirect business enterprises that subsequently open shop, specifically, servicing cars, eateries, coffee shops, convenience shops, banks (ATMs), cleaning, security, construction, contractors and additionally, marketing, PR, and advertising via Internet of Things (IOT), which is the income-earning forte of our youth.

We also have approximately 4,000 road tankers in the EAC region, with approximately 1,800 being in Kenya. This value chain is a catalytic enabler to other enterprises that include mechanics, petroleum tanker manufacturers, fabricators, motor vehicle assembly, mounting and technological innovations, among others, not forgetting the drivers. The downstream sector alone creates thousands of jobs and contributes over 100 billion in tax revenue. The sector remains critical in economic growth.

The country entered into a G-2-G deal in 2023, which informed the decision and where are we with it?

If you remember in 2022 and 2023, Kenya faced recurring fuel shortage crises primarily driven by a shortage of US dollars for imports, government issues with paying oil marketers for subsidies and high global fuel prices, which were mainly as a result of geopolitical factors. We had a major shortage in 202,3, leading to long queues, rationing and disruptions, with solutions proposed like shilling-based purchases and new credit deals.

The government, working with industry players and the private sector, sat down and thought deeply on how to address the problem. The government-to-government deal was hence entered into in March 2023 with companies from the UAE and Saudi Arabia to stabilise the economy and currency by importing fuel on credit. The industry at the time needed at least $500 million (Sh65 billion) monthly for fuel imports, and we all saw what happened with the dollar shortage.

The deal hence allowed us to defer payment for oil imports by 180 days, which reduced the immediate demand for dollars and helped to strengthen the Kenyan Shilling. G2G was something that became a cure and helped us stabilise the petroleum industry and drive the economy to where we are today.

This is something that even our

neighbours have come to benchmark, including Uganda,

South Sudan, Rwanda. Even Nigeria, an oil-producing

country, has asked what our secret has been to stabilise fuel prices. Working

with industry players, we have been able to stabilize

the fuel industry. The supply for Kenya and the regions, I think, is now

stabilized. There is no noise.

Kenyans say the cost of fuel is still high. What is your take?

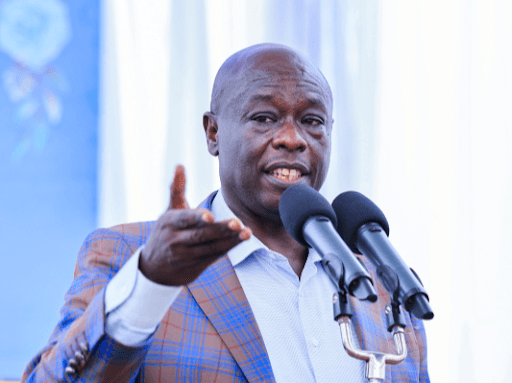

You see, during campaigns, one of the things that His Excellency the President did was to listen to Kenyans, especially on social demands. One thing that stood out was the cost of living and the cost of living is basically based on two issues. One is about the food and secondly, fuel costs.

There is a time when fuel prices crossed the 200 mark, which also pushed up commodity prices. Immediately, he took over, he started addressing the key issues affecting the country. Fuel prices came down and stabilised based on the global benchmark; of course, there are import costs and so forth. But I can say the fuel prices have stabilised, which has helped bring down the cost of living and continues driving economic growth.

It has been 13 years since Kenya discovered its first commercially viable oil reserves in the Lokichar Basin, Turkana. Why has it taken so long to go commercial and what are the prospects?

One thing you must appreciate is that the oil industry is inherently capital-intensive, meaning it requires massive upfront investments in expensive machinery, exploration, infrastructure like pipelines, rigs, refineries, and technology. But we are making progress. Gulf Energy, which took over the Turkana fields from Tullow Oil, has already submitted a revised Field Development Plan for the South Lokichar oil project. It has been approved by the regulator, the ministry and is currently before Parliament.

We are hoping that the expedited ratification to allow investment and oil production by early next year. We can start slowly with 20,000 barrels per day for the next two years, then increase it to 50,000 barrels per day. We are also ensuring that all the infrastructure is in place.

We have a storage facility in place that is the Kenya Petroleum Refineries Limited facility,y recently acquired by Kenya Pipeline Company, port and also the construction of an 895 km crude oil pipeline to link the Turkana oil fields to the Lamu Port for export.

The land issues, including compensation, have been looked into. The county government and locals are involved, so yes, we are headed there and this is a project that will create jobs and empower our people.

We are also looking into how best we can have investors come on board on the other oil blocks. It is a collective effort and I believe we will get it right and make Kenya an oil-exporting country.

Tell government has an ambitious plan to grow LPG use. Where are we so far?

We have made tremendous progress. The latest numbers show LPG consumption increased by 15 per cent, with 414,861 metric tonnes consumed in 2024 in comparison to 360,594 metric tonnes consumed in 2023.

The volume of LPG consumption in January to September 2025 was 359,613 metric tonnes already, signifying a positive growth of 20 per cent compared to January–September 2024 consumption.

This increase is attributable to initiatives such as the zero rating of the product in June 2023, the promotion of clean cooking and the government led national LPG growth strategy that seeks to eradicate the domestic and industrial use of firewood, charcoal and other carbon emitting fuels that are derived from our forests as well as the elimination of domestic kerosene as primary sources of energy while switching to LPG.

Notably, the ongoing support from the regulator and policy maker on enforcement of the LPG regulations has boosted the much-needed investor confidence to deploy more cylinders in the market as well as LPG in public institutions in support of the full implementation of government’s national LPG strategy objective.

We target to convert at least 74 per cent of Kenyans to cleaner cooking. We are working with the private sector, which is putting up bulk storage facilities in Mombasa. Asharami is bringing about 30,000 metric tonnes.

Taifa Gas is also coming on board. Once that is done, then we will be looking at how we are going to bring all these terminal owners into the Open Tender System.

This will help bring down cooking gas prices. Meanwhile, they have made progress in converting our schools to the use of cooking gas. We have about 9,500 schools according to the Education Ministry and the plan is to convert them all.