The government should not increase taxes in the Finance Bill, 2025, as that will only stifle production, resulting in much lower revenue for the government, according to a tax experts.

Speaking at a pre-budget briefing session in Nairobi, economists and accountants at Ernst & Young said that the high tax regime imposed in the past decade has almost saturated the economy.

"You cannot defy the Laffer curve theory and survive. Tax measures must be of mutual benefit between the public and the state," Ernst &Young said in a brief.

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue.

It assumes that no tax revenue is raised at the extreme tax rates of zero per cent and 100 per cent, meaning that there is a tax rate between zero per cent and 100 per cent that maximises government tax revenue.

Experts at Ernst &Young have termed the government’s ambition to collect Sh3.4 trillion in taxes to fund the ambitious Sh4.3 trillion budget for the financial year starting July 1 as unrealistic in the current setup.

“The government can only meet this target if it cuts taxes. This will encourage production and avail disposable income. The rollout of digital infrastructure like the electronic tax invoice management system (eTIMS) and data-driven strategies will encourage voluntary tax remittances,’’ the firm said.

Although the Finance Bill, 2025 is yet to be finalised, the state has floated key tax measures, including the implementation of a minimum top-up tax for multinational enterprise (MNE) groups, transition to significant economic presence tax from digital services tax, repeal of certain tax exemptions, and withholding tax on digital marketplace income.

The government aims to increase the tax-to-GDP ratio to 20 per cent by FY 2026/27 and 25 per cent by 2030.

The regime is already struggling to meet this year’s target. Between July and December 2024, the taxman collected Sh1.07 trillion, a shortfall of Sh160 billion compared to the Sh1.23 trillion required to stay on course to meet the full-year target of Sh2.47 trillion.

The shortfall comes at a time when the government has been grappling with the consequences of the Finance Bill, 2024's rejection.

The bill, which included a series of proposed tax increases, was dropped under pressure from widespread protests earlier in the year.

This rejection has led to concerns over the government's ability to raise the necessary funds to finance its budget.

The experts voiced their concerns about the country’s debt, saying that the government must be deliberate in its strategies to avert the risks of defaulting.

“The country’s debt position is in bad shape. We are, however, hopeful that the country’s talks with the International Monetary Fund (IMF) for a new precautionary facility will yield. That will help in ironing out volatilities.’’

This is a different opinion held by their counterparts at Standard & Poor's (S&P), who last week warned that the new arrangement will likely lead to lower credit growth in Kenya’s economy.

“We anticipate that the new program will impose stricter fiscal conditions, leading to tighter monetary policies and higher interest rates. This is consequently expected to increase borrowing costs for banks and customers, to exert pressure on borrower repayments, and to elevate the risk of loan defaults,’’ S&P states in the monthly banking risk outlook for April.

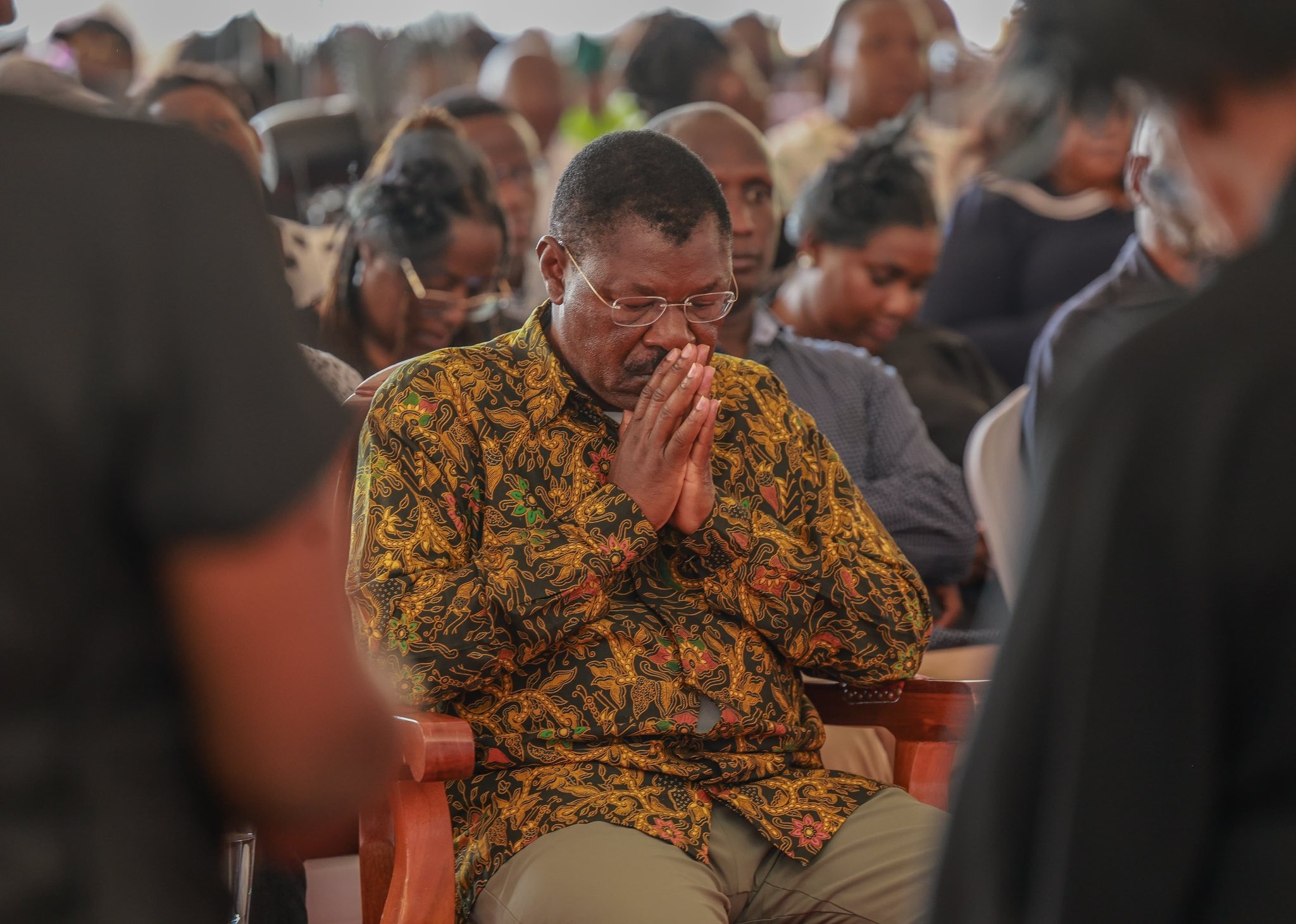

On Tuesday, Kiharu Member of Parliament Ndindi Nyoro raised the red flag, warning that the country is in a debt crisis and could soon join Africa's debt defaulters club.

Speaking at the Institute of Public Finance annual budget review, the former Budget and Appropriations Committee chairman said the country’s public debt, currently estimated at Sh11 trillion, is worrying, adding that any attempts by the government to renegotiate existing debt could prove to be even more catastrophic.

Over the last twelve years, the country’s debt has grown from just under Sh2 trillion to Sh11 trillion, according to government estimates.

Various economic experts who are warning against Kenya’s plan to renegotiate debt payment and seeking another arrangement with the IMF echo his sentiments.

Economist Daniel Mailu fears a market reaction to Kenya’s plan to renegotiate debt repayment when President Ruto visits China. “It will technically be passing the message that the country is broke. The international market is very unforgiving.”

Mihr Thkar sees the shilling, which has been holding steady against the US dollar, start tumbling. He fears that the current global trade war will worsen the situation.