The Kenya Revenue Authority (KRA) is mulling a comprehensive review of taxes imposed on sugarcane by-products to curb smuggling from the neighbouring East African Community (EAC) partner states.

This follows concerns from players in the sector over rising cases of smuggling of molasses, ethanol and alcoholic beverages through the porous borders with the neighbouring countries.

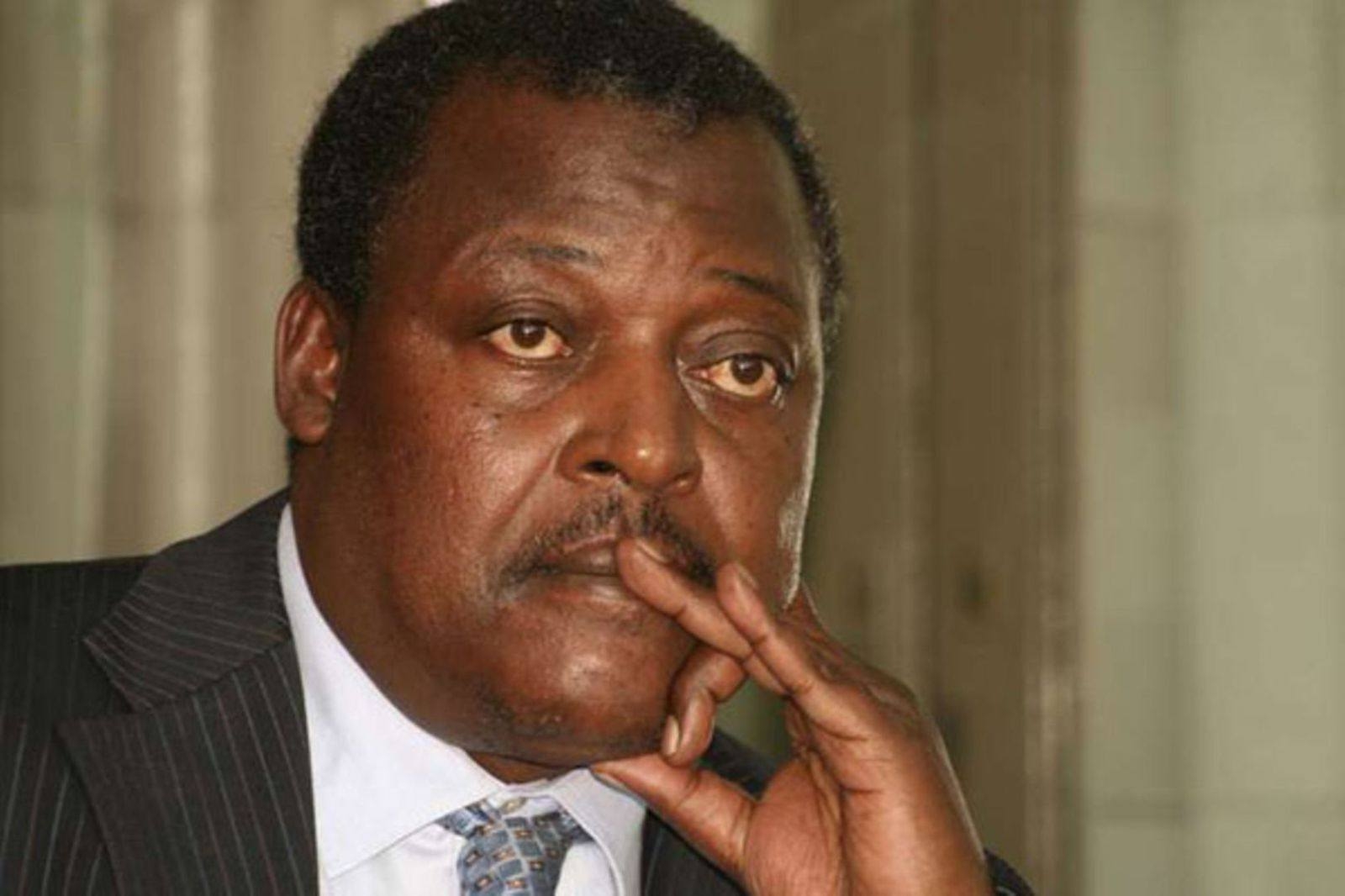

Speaking in Kisumu during a stakeholder engagement forum with players in the sugar industry from Western Kenya, KRA Board Chairman Nderitu Murithi acknowledged that price disparities between Kenya and its EAC neighbours have made illicit trade in the by-products a lucrative enterprise.

“We have had very candid discussions with the traders and distillers. There is consensus that the existing tax regime marked by pricing differentials between Kenya and its neighbours is a significant factor fueling smuggling activities,” Murithi said.

KRA, he said, will take up the matter with the National Treasury to explore a tax policy framework that achieves a balance to discourage smuggling.

The stakeholder engagement, he said, was part of KRA’s broader initiative to foster transparency and partnership with taxpayers.

Murithi said the forums were designed to ensure taxpayers are fully informed about their obligations, upcoming policy changes, and the tools available to facilitate easier tax compliance.

“We have made presentations on the Electronic Tax Invoice Management System (eTIMS), the electronic rental income tax platform, and key highlights of the Finance Bill,” he said.

This, he added, was a continuous effort by the Board and management of KRA to engage the public and keep them abreast of the various services, innovations, and strategic plans.

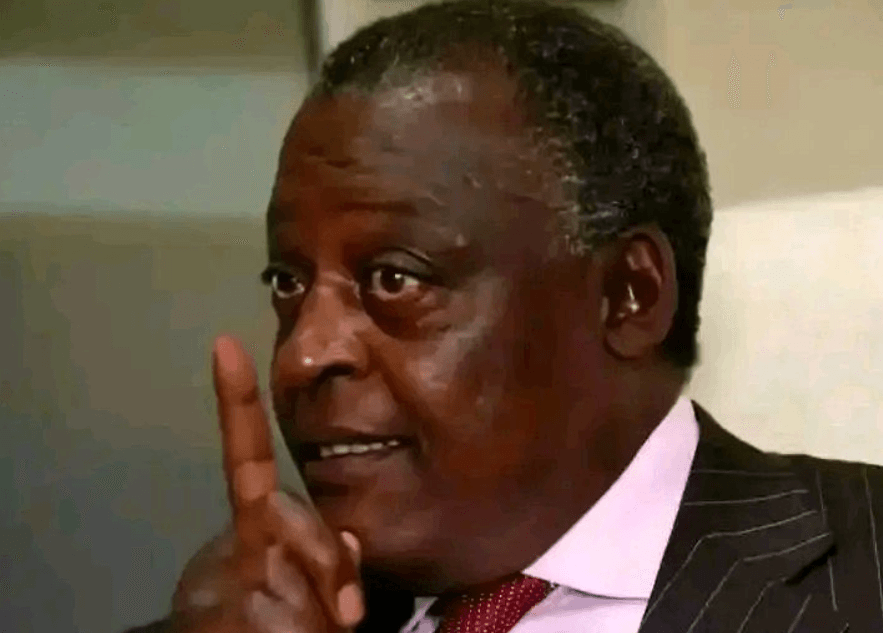

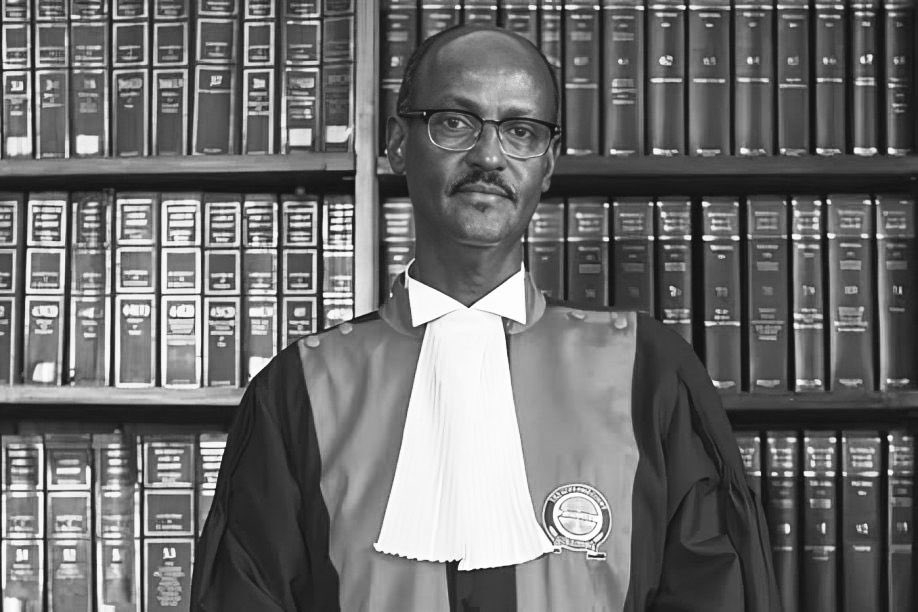

KRA Commissioner for Legal and Board Services Paul Matuku, reiterated that the public fora were crucial platforms for identifying and addressing the various challenges that hinder tax compliance.

He stressed the need for cooperation between the tax collector and businesses to develop practical, responsive tax policies.

Commissioner Matuku also urged Kenyans to take advantage of the ongoing tax amnesty programme, which offers individuals and businesses the opportunity to regularise their tax status without facing penalties.

The programme, he noted, was a golden opportunity for taxpayers to start afresh, but warned that the amnesty window was soon expiring.

The Kisumu engagement was one of several regional forums organised by KRA to solicit feedback, demystify tax processes, and promote a culture of voluntary compliance among taxpayers across the country.